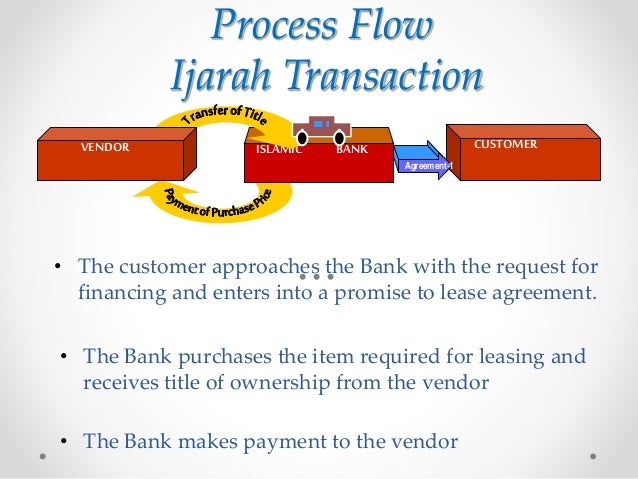

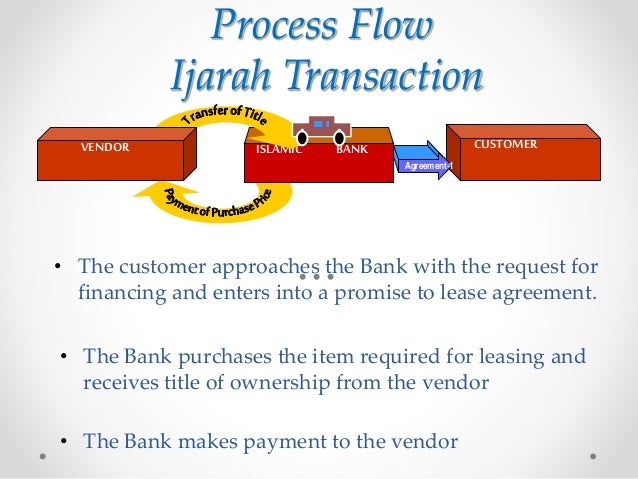

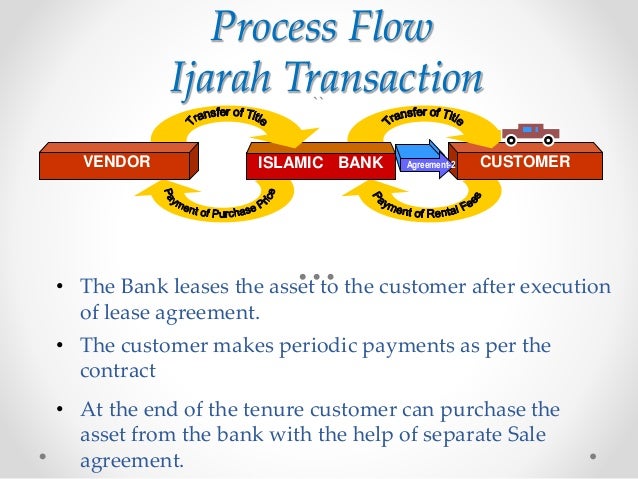

car ijarah financing steps

Ijarah transaction between Islamic Bank and Client. Re-financing takeover - bring over your home finance eg.

Car Financing In Islamic Banks Methodology And Ways

Personal loan is the most suitable mode of financing as it gives you a loan for 1-5.

. Equity Release - follow your dreams use the cash. Gradual sale of Musharakah units by Bank to the client on periodic basis and at the end of the financing tenure client becomes the sole owner of the asset. Up to 2 units with PHLAN programme.

A DM Financing is a combination of Musharakah Ijarah and Sale transaction. From another bank to be financed by ADIB. It can help you to bridge your financial needs through any financial institution Normally personal loans are used for home improvement child education fee wedding expenses debt consolidation buying household items going on vacation buying another car purchasing property or businesses.

Construction financing - building constructing a property on a land you own or has been given to you. Developers financing - finance a property from major developers that we work with. A DM based Auto financing transaction comprises of mainly following three steps.

0 Response to "car ijarah financing steps"

Post a Comment